❄️Are we bored of FTX yet? ❄️ACJR’s winter crypto journalism + research round-up

The very last ACJR newsletter of 2022 — now, on to 2023!

The penguins have no deeper meaning. We just wanted to show you something cute and wintery.

November and December have probably been the busiest months in crypto journalism’s recent history. Sure, the Mt. Gox hack and The DAO hack probably had newsrooms going crazy at the time, but the industry has gotten so big since then that the continuous FTX stories have hundreds of journalists (in our approximation) working crazy hours to catch all parts of the story.

In this month’s ACJR newsletter, we are dedicating the lion’s share to what continues to be the top story, FTX, including hopefully a 360 degree view of what has been written — opinion pieces, SBF’s many, many public interviews, general mainstream articles, niche crypto-native articles, etc. We can’t promise to have caught everything, but hopefully a glance through this newsletter gives you a highlight reel of the best FTX + fallout stories in the space.

But before we dive in…..

ACJR election update

Our members have voted — and we have a new board!

We’re pleased to announce the 2023 ACJR board members:

President: Sam Reynolds

Vice President: Marina Spindler

Treasurer: Mitchell Moos

At Large, in alphabetical order:

Samantha Howard

Joanna Ossinger

William Richter

Molly Jane Zuckerman

₿ 😎 ₿

Top crypto journalism in November/December

Editor’s note: we have tried our best to showcase stories in the order that the FTX saga has unfolded. If we’re a bit out of order, we tried! We’ve also kept our descriptions short and sweet — the headlines this issue really speak for themselves.

We’d like to give special mention to some smaller (or new) news outlets that have published outstanding stories during the FTX news cycle, namely Semafor and Axios.

FTX stuff

Before Deal With Rival, FTX Scoured Wall Street, Silicon Valley Billionaires for $1 Billion Lifeline by Liz Hoffman, Bradley Saacks, and Louise Matsakis, Semafor

After its fall launch, Semafor has already broken some big stories with the FTX crisis. This particular piece covers what FTX was doing before the bankruptcy filing (and before the now-defunct acquisition deal with Binance).

FTX Agrees to Sell Itself to Rival Binance Amid Liquidity Scare at Crypto Exchange by Tracy Wang, Nick Baker, Coindesk

Even though this deal did not go through, Tracy’s reporting on an acquisition that was announced (and then canceled) through Twitter announcements was an important milestone in early FTX crash coverage.

8 Days in November: What Led to FTX’s Sudden Collapse by David Z. Morris, Coindesk

As Coindesk was the publication that broke the Alameda story that started FTX’s downfall, this coverage that dives into the timeline of the crash was a necessary explainer back before SBF started his overly honest tweet threads.

Focus Turns to Alameda as Investors Fear Binance Deal Not the Answer for Stricken FTX by Samuel Haig, The Defiant

While the possible Binance acquisition was seen as good news at the time for FTX clients, this piece goes deeper into what the crypto industry would look like with a consolidation of major exchanges.

It Was All a Game for Sam Bankman-Fried by Kevin T. Dugan, New York Magazine

An early, but comprehensive piece into SBF’s history in crypto.

Sam Bankman Fraud: Inside the Collapse of FTX’s Hollow Empire Nathaniel Whittemore (podcast)

For those that prefer to listen to their news, rather than read it.

How Sam Bankman-Fried’s Crypto Empire Collapsed by David Yaffe-Bellany, New York Times

Possibly the most contentious coverage of Sam Bankman-Fried, this article is an important milestone in the FTX saga both for the publicity it attracted and the criticisms it received.

Sam Bankman-Fried Tries to Explain Himself by Kelsey Piper, Vox

Another piece of journalism that received some criticism this news cycle — but from SBF himself, who claimed he didn’t realize his conversation with a reporter could be turned into a news story…

‘Queen Caroline’: The ‘Fake Charity Nerd Girl’ Behind The FTX Collapse by David Jeans, Sarah Emerson, Richard Nieva and Michael del Castillo, Forbes

With all of the focus on Sam, this Forbes piece also elucidates a bit more about Alameda’s young CEO Caroline.

Centralization Caused the FTX Fiasco, by Vivek Ramaswamy and Mark Lurie, Wall Street Journal

This piece was lauded in crypto media for making the distinction between centralized and decentralized crypto companies — and putting FTX firmly on the “centralized” side.

Tiffany Wong’s interview with SBF

This interview, while more along the lines of citizen journalism, shook the crypto (and wider) space as it was Sam Bankman-Fried’s first (of many) public interviews.

Online News Site CoinDesk Attracts Suitors Amid Crypto Crash by Bradley Saacks and Liza Hoffman, Semafor

Another meaningful piece from Semafor, which examines what could happen to Coindesk as its parent company feels the effects of the industry meltdown.

Crypto Lender BlockFi Filing for Bankruptcy and Conducting Major Layoffs as FTX Contagion Claims Another: Source, by Liam J. Kelly and Daniel Roberts, Decrypt

Decrypt does a good job explaining how BlockFi’s new bankruptcy case is connected to the FTX bankruptcy case.

What Does Sam Bankman-Fried Have to Say for Himself? by Jen Wieczner, New York Magazine

In yet another one of Sam’s public interviews before the arrest, this piece highlights all of SBF’s logical maneuverings and explanations of FTX billion(s) of missing customer funds.

FTX’s Collapse Was a Crime, Not an Accident by David Z. Morris, Coindesk (Op-Ed)

After a very contentious profile of SBF in the New York Times (by writer David Yaffe Bellany featured below), this opinion piece lays out all of the mistakes that crypto reporters see in the wider FTX coverage.

Inside the Frantic Texts Exchanged by Crypto Executives as FTX Collapsed by David Yaffe Bellany and Emily Flitter

Further, still important, NYT coverage that uncovers more about how top crypto exchange operators are in contact with each other.

Exclusive: SBF Secretly Funded Crypto News Site by Sara Fischer, Axios

A truly shocking revelation relatively late into the FTX drama that shook the crypto media landscape.

Who Will Pay Sam Bankman-Fried's $250 Million Bond? by Mat Di Salvo, Decrypt

A really important story to get right, as many were left quite confused where SBF was able to get a hold of $250 million. The answer? An appearance bond doesn’t require all of the cash upfront, as explained by Decrypt.

Taking Down SFBF: How the Website CoinDesk Shook Up the Crypto World by Kevin T. Dugan, New York Magazine

A nice, public recognition for Coindesk and the journalism by Ian Allison that started the FTX landslide.

Non-FTX stuff

We’d be remiss if we didn’t include *any* non-FTX coverage, so these two stories made the cut.

Ethereum Founder Vitalik Buterin Calls Governance Token Speculation ‘Pathological’ by Kate Irwin, Decrypt

As debate about the crypto markets in general continues, this piece explains what Buterin’s latest comments on governance tokens means.

New Treasury Sanctions Link Tornado Cash to North Korea's Nuclear Weapons Program by Kollen Post, The Block

Always relevant, this piece covers just what else is going on with North Korea’s crypto funding.

And now — on to some research!

₿ 😎 ₿

Top crypto research in November/December

It’s the time of year for 2022 wrap-up reports!

The Block’s 2023 Digital Assets Outlook

CoinMarketCap’s 2023 Crypto Playbook

(disclaimer that the author of this newsletter works for CoinMarketCap).

₿ 😎 ₿

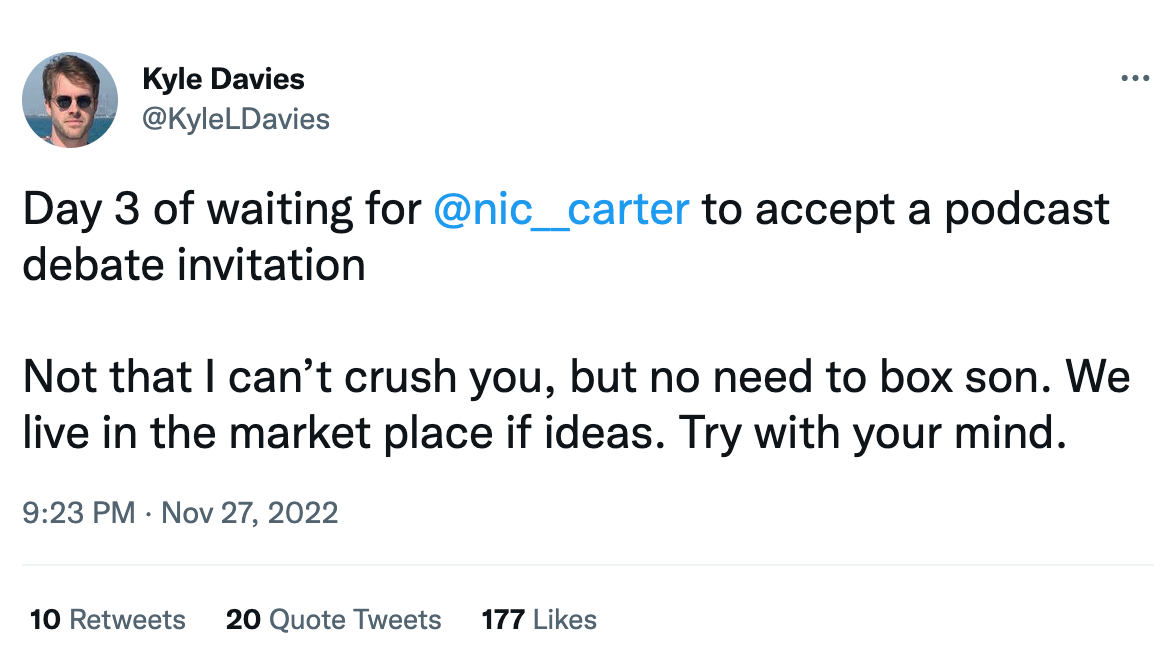

Top crypto unhinged tweet(s) in November/December

Every crypto bro who had a failed company this year came out of the woodwork to comment on truly *anything* on Twitter

Even Edward Snowden started Twitter trolling.

And last but not least, remember when this thread was huge news?

We can’t wait to see you all next year for our first newsletter of 2023 — until then, find us on Telegram and Twitter!

Join the ACJR

If your New Year’s resolution has anything to do with learning more about cryptocurrency in these wild times — then maybe you should add joining the ACJR to your list. Beyond this lovely newsletter and our open Telegram chat, dues-paying ACJR members get access to our members’ only chat, various discounts and event invites plus much, much more in the new year.

If you want to become an official member of the ACJR, please reach out to any of the current board members on Telegram, or Joyce Pavia Hanson: @JPHanson.

Got an opinion?

Reach out to Molly Jane or Anthony on Telegram if you have some ideas for our first op-ed of 2023.

Subscribe now! It’s never too late — in crypto, you’re always early.