Happy (belated) St. Patrick’s Day from the Association of Cryptocurrency Journalists and Researchers! 👋

It’s time to vote for the first ever (but definitely not the last) ACJR awards! This spring, reporters and researchers in the blockchain space will have the chance to win awards in three categories: Reporter of the Year, Researcher of the Year, and Story of the Year. You can vote for your favorite articles and reports here — but you need to be an ACJR member first, which you can easily apply for right here.

That’s right — ACJR is finally open to membership applications! At the risk of repeating ourselves, you can fill out a quick application form here and we’ll get back to you as soon as the raging bull market allows us.

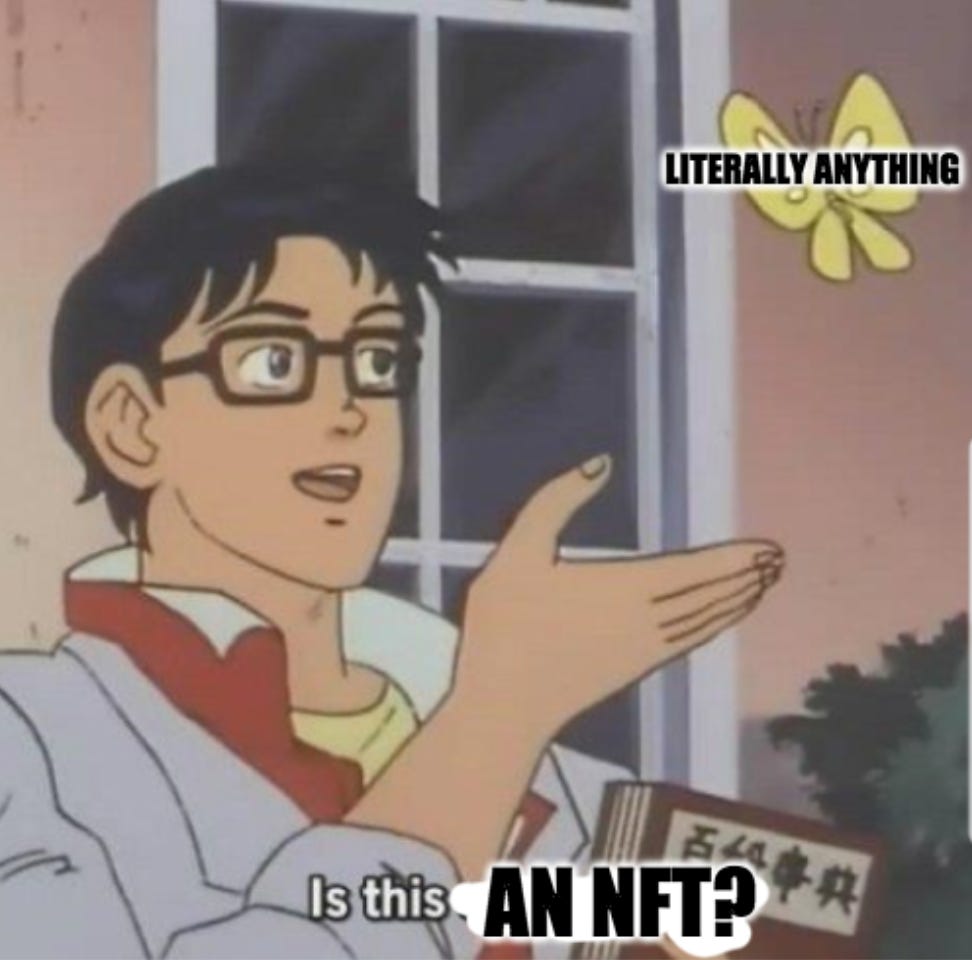

Coverage of the NFT craze hasn’t slowed down in March — in fact, this newsletter now features as many pieces from mainstream outlets as from crypto outlets. This is exactly the kind of blockchain literacy that ACJR aims to encourage!

Besides the awesome articles we’ll discuss below, The Defiant released a documentary film about NFTs. There are several new multimedia projects that are worth checking out. For another example, we loved seeing how Isaiah Jackson’s new CoinDesk TV program, Community Crypto, explores bitcoin usage in Black communities across the United States.

Bitcoin also reached a new all-time high in March, which is almost getting boring at this point. Luckily, many stories that we liked dug deeper than Bitcoin’s rollercoaster price swings.

₿😎₿

The beginning of March saw another first for our industry — Janine Roem received a $10,000 grant from the Human Rights Foundation for her privacy tech newsletter, making her the first journalist to get funding from an open source bitcoin grant. We want to see more of this!

Plus, in the realm of crypto research, we wanted to highlight Coin Metrics for their “State of the Network” issue in March, all about Ethereum. With regards to traditional reporting, here are some of the outstanding pieces that we enjoyed in March:

“From Crypto Art to Trading Cards, Investment Manias Abound” by Erin Griffith, New York Times

This piece compares the exploding NFT market with a host of other “manias” like trading cards and sneakers. We loved the simple explanations and the way this article provides broader cultural context.

“Porn Creators Are Getting In on the NFT Craze” by EJ Dickson, Rolling Stone

This newsletter is going to be a little NFT-heavy because ‘tis the season. As such, we’re highlighting this article because we love how it explores the legal issues surrounding NFTs. It remains to be seen how NFT platforms will regulate adult content. For now, some sex workers are earning money by selling collectible crypto porn.

“Coinbase CEO Could Get More Than $1 Million Per Day After IPO” by Simon Hunt, Bloomberg

When it comes to fintech coverage, large numbers like $1 million and $1 billion are thrown around every day. This piece does a great job of humanizing such numbers, breaking down how one person could make so much money as Coinbase goes public.

“Binance Smart Chain’s Musical Beats, Alleged Ethereum Copycat, Shuts Down Days After Launch” by Jeff Benson, Decrypt

In the realm of open source technology, there is nothing to stop anyone from literally copy and pasting someone else’s project. So this article explains what happens when an NFT project gets copied on another blockchain. As it turns out, even open source advocates say “decentralization shouldn’t mean copycats fly free.”

“Pakistani Province Plans To Build Pilot Cryptocurrency Mining Farms” by Umar Farooq, Reuters

We love the way this article addresses the energy consumption issue without moralizing the environmental costs or fixating on it. Many developing nations want a more prominent role in the global economy than they currently have in the dollar system. This piece frames that topic with political context. Kudos!

“Nigeria Can’t Decide What To Do About the Rise and Fall of Cryptocurrency” by Innocent Chizaram Ilo, Rest of the World

We love so many things about this article, written by a Nigerian with intimate knowledge of his local market. That cultural competence really shines through, with regards to both the sourcing and references to local politics. We hope to see more outlets hiring diverse freelancers to report on the nuances of local bitcoin trends. After all, rumor has it that cryptocurrency can be useful for paying freelancers across borders.

₿😎₿

Remember, ACJR has a lot more going on than just this (fabulous) newsletter. You can suggest topics for our future online meetups and participate in our book club via Telegram. If you want to help us with upcoming programs, please contact us via social media or our website.

☝️☝️☝️

Next, we’ll turn to a guest column from Bitcoin Magazine editor Aaron van Wirdum, about why he isn’t covering the NFT craze:

21 million, that’s the limit.

It’s an arbitrary number, of course. It could have been 10 million. Or 21 trillion. In fact, since each of the 21 million bitcoin can be divided into 100 million sub-units, you could argue that the real number is 2.1 quadrillion. But that’s complicating things. Satoshi Nakamoto offered the world digital scarcity, and he chose to divide it into 21 million units.

The 21 million limit matters. If Bitcoin ever becomes the world's reserve currency, owning one bitcoin means you’d own exactly 1/21,000,000 of the global money supply. “Even if the odds of Bitcoin succeeding to this degree are slim,” Bitcoin pioneer Hal Finney reasoned, they’re probably not zero. This lets you make a risk/reward calculation and, like Satoshi Nakamoto himself, draw the conclusion that “it might make sense to get some in case it catches on.”

Most journalists cover all cryptocurrencies as if they’re equal. But if Litecoin, with its 84 million coins, is considered an equal to Bitcoin, that makes for a total of 105 million units. Add XRP, and we have a total of 100,105,000,000. Never mind Ethereum; its supply even changes whenever its developers decide it’s time to change it. And I don’t even understand the latest hype around NFTs.

No, if we consider all cryptocurrencies as if all are equal, the rationale for valuing any of them falls apart. Covering cryptocurrencies as if all are equal, then, might encourage investment in speculative distractions. That’s why I cover Bitcoin-- and only Bitcoin.

21 million, that’s the limit.

₿😎₿

That’s it for March! Please keep sending us all the memes, and of course, follow us on Twitter, join our Telegram group and check out our website. We can’t wait to see what the market has in store for us in April!