💙 Spring brings rings and things 💙

The best crypto and blockchain journalism and research from April and May

“Why doesn’t Congress like me?” wondered the innocent Shiba Inu: source

There have been a lot of fires this month — and no, we don’t just mean in Canada. We mean in crypto. We’ll keep this introduction short and sweet, since we have probably our largest newsletter yet: our April/May issue covers all of the top stories so far this spring.

You may think — I don’t want to look backwards! I want to look forwards, towards more think pieces about what on earth the SEC is doing to the US crypto industry.

But we’d argue — how will you understand what’s happening now if you don’t reflect back on the best journalism that got us to where we are today?

Reach out to Molly Jane or Anthony on Telegram if you’d like to contribute an op-ed for our next issue. We know there are tons of topics that ACJR members feel strongly about, so why not write out your feelings in our newsletter?

Before we dive into the top crypto research and journalism this month…..

Congratulations to all of the companies named in Fortune’s inaugural Crypto 40!

p.s. 💙 BLUESKY GIVEAWAY 💙 — if you subscribe to our newsletter and tweet at us with a screenshot of your subscription by this Friday, June 16, 11:59pm EST, we will enter you in a raffle to win a coveted Bluesky code!

On to the articles!

Top crypto journalism in April & May

Elon Musk's Dogecoin hype draws attention to mysterious wallet that once held $24 billion by Adam Morgan McCarthy, The Block

It wouldn’t feel like a crypto cycle if everyone’s favorite (source?) canine didn’t make an appearance: dogecoin saw a steep price jump after Elon Musk replaced the Twitter bird with the dogecoin doggo (and subsequently crashed when the logo was removed). With all eyes on Musk and doge, speculation around a dogecoin whale wallet bubbled up. Adam’s piece does a great job incorporating on-chain data to support the story.

What if ChatGPT was trained on decades of financial news and data? BloombergGPT aims to be a domain-specific AI for business news by Joshua Benton, Nieman Lab

Straight from the “embrace AI” front, Bloomberg released a domain-specific chat AI called BloombergGPT. The article helps surface why Bloomberg created the AI and some ways that it’s already useful internally. After all the AI-Doomerism following GPT4’s launch, this comes as a stark example of how AI can help organizations empower their people instead of replace them.

The Block fires a third of staff — Larry Cermak is CEO, Wintermute’s Evgeny Gaevoy joins board by Amy Castor, David Gerrard

Crypto skeptics Amy and David report on The Block’s layoff and leadership transition. Their investigation into the situation at The Block and the former CEO’s ties to Sam Bankman-Fried and attempts to generate revenue for the site provide valuable context for the staffing shakeup. Suggesting that Wintermute’s Evgeny Gaevoy is the next SBF seems too speculative at this point (more like wishful thinking from a detractor), but they raise points worth keeping in mind.

Waves founder’s role in lost $530m raises questions about who’s to blame by Tim Craig, Isabel Hunter, DL News

The DL News reporters follow up on the story of Waves blockchain exploit that drained lending protocol Vires Finance of over $530 million. DL News analyzed on-chain data which suggests that Waves blockchain founder Aleksandr Ivanov may control the wallets behind the exploit.

The US is losing crypto talent as blockchain devs seek safer havens by Jacquelyn Melinek, TechCrunch

Jacquelyn puts a spotlight on what many in the crypto industry have begun to feel — in light of the US government’s increasingly hostile stance towards crypto, blockchain developers are leaving the country. Jacquelyn’s investigation revealed that despite trending down, losing developer talent may not be a cause for worry as more teams embrace globally distributed workforces.

Scaramucci’s SkyBridge capital was spiraling, and then came FTX by Katherine Burton and Francesca Maglione, Bloomberg

This incredibly well-written piece from Bloomberg charts the slow deflation of SkyBridge Capital, Scaramucci’s hedge fund which took significant losses just through market movements throughout 2022 and then suffered a major reputational hit after SBF was arrested. Authors Katherine Burton and Francesca Maglione tear apart SkyBridge’s history and track record and uncover details about the fund’s relationship with FTX.

Brazil’s Bitcoin Beach says lightning network works better than Visa by Kenneth Rapoza, Forbes

We love to see crypto working — here, Kenneth tells the story of Brazil’s Bitcoin Beach and its creator, Fernando Motolese. The piece documents the small community’s efforts to date to use the Lightning Network and Bitcoin to decouple their local economy from its dependence on the dollar. Importantly, the piece addresses the positives and negatives of the Lightning economy.

The real-world costs of the digital race for Bitcoin by Gabriel J.X. Dance, New York Times

On behalf of the New York Times, Gabriel “traveled to Texas and North Dakota, interviewed Bitcoin miners, energy experts, scientists and politicians and analyzed thousands of records detailing mining operations for this story,” in an attempt to expose the dirty truths behind Bitcoin mining. Instead, he emerged with a valid critique of the state of Texas’ power grid.

The New York Times' skewed Bitcoin mining exposé reveals blatant bias by David Z. Morris, Coindesk

This response to the above New York Times piece from David Z Morris at Coindesk makes one big point: there are very real challenges with Bitcoin’s energy consumption, but they were not addressed in the NYT article which instead seemed to focus more on sensationalizing a handful of metrics out of context.

Crypto investors face delays in withdrawing funds after Ethereum upgrade by Elizabeth Howcroft, Reuters

This article from Reuters covers the long wait times ETH holders faced when attempting to withdraw their staked Ether after April’s Shapella protocol upgrade. Noteworthy in this piece: the author cites the long wait times for withdrawals as evidence of Ethereum’s technical limitations for scaling throughput, when further in the story a Nansen analyst is quoted as pointing out the limitations were a security measure.

Vitalik says Ethereum will focus on scalability post-Shapella by Samuel Haig, The Defiant

Alongside Vitalik’s comments on where development efforts will be focused going forward, this article also provides history around Ethereum’s Shapella upgrade, valuable context for understanding why the Shanghai and Capella forks were significant.

Ethereum’s Shapella upgrade went through despite ‘ridiculous bug’ by

Macauley Peterson, Blockworks

Though a short story with a happy ending (a built-in security measure prevented any catastrophic outcomes), this article does a good job of simplifying the complex bug and resolution.

Anti-crypto regulators are blocking the pathway to a digital American dream by Li Jin, Fortune Crypto

This piece of commentary by Li Jin for Fortune Crypto is a rare example of a mainstream media outlet of this caliber publishing such a direct pushback against regulators’ actions against crypto in the US. Li does a good job framing the crypto industry’s frustrations in ways an audience with a background in traditional finance can empathize with.

S.B.F. and The Mooch’s Arabian Nights by William D. Cohan, Puck

Because the SBF/Scaramucci story needed a twist, William Cohan gives us an inside look at their fundraising efforts in the Middle East and sheds more light on their relationship just before the collapse of FTX.

The crypto detectives are cleaning up by David Yaffe-Bellany, New York Times

This article covers the rise of on-chain analytics start-up Chainalysis. The company rose to prominence as a leading investigative agency in the crypto industry, assisting the government and law enforcement in investigating crypto fraud. David does a good job of highlighting the tension between Chainalysis and crypto advocates who believe in the privacy and anonymity of digital currencies, raising questions about the future of cryptocurrency and the balance between law enforcement and privacy.

SBF’s ‘ghost is still in this room,’ congressman says at digital asset hearing by Stephanie Murray, The Block

Representative Brad Sherman discussed Sam Bankman-Fried, the former FTX CEO, during a hearing on regulatory gaps in the digital asset market structure. Sherman criticized Bankman-Fried for trying to prevent the SEC from having jurisdiction over cryptocurrency and instead advocating for regulation through the CFTC. This article stands as another example of the damage SBF did to the crypto industry and the lasting impact he is having on its growth.

Is the federal government trying to kill off crypto? by Jen Wieczner, Intelligencer

Jen does a top notch job discussing the regulatory challenges crypto companies face in the US, even when trying to comply. The article looks at Protego Trust, a crypto company that invested significant time and money to obtain regulatory approval but was denied on a technicality, and suggests a coordinated effort by financial regulators to make it difficult for crypto firms to operate in the country, drawing parallels to Operation Choke Point (a previous government policy that targeted certain industries).

Memecoins lead crypto declines after weighing on Bitcoin fees by Vildana Hajric and David Pan, Bloomberg

This article discusses the decline in prices of memecoins like Pepe and the then newly launched Ordinals, following a surge over the weekend. The declining value in these memecoins could suggest market sentiment has moved on, highlighting the limitations of coins without utility driven solely by hype.

Shaq rejects FTX fraud suit, saying summons papers were thrown at his car by Joel Rosenblatt, Bloomberg

The lawsuit against SBF and FTX continues to provide more drama, this time featuring basketball legend Shaquille O'Neal. The player's attorneys argue that throwing the legal document at his car as he entered his Georgia home does not qualify as properly serving a lawsuit. Shaq has ironically since been served at what is now the Arena Formerly Known as the FTX Arena.

US exchanges list more than a dozen cryptos the SEC says are illegal to sell by Peter Santilli, Caitlin Ostroff, and Dave Michaels, Wall Street Journal

Another example in the SEC’s long history of attempts to bring cryptoassets under their jurisdiction and their inconsistent, often aggressive tactics to accomplish that goal.

Jump Trading did secret deal to prop up TerraUSD stablecoin, SEC says by Alexander Osipovich, Wall Street Journal

For those continuing to track the fallout of Terra/LUNA’s collapse: the court filings released by the SEC show that Jump Trading was the unnamed firm that made substantial profits through its dealings with Terraform Labs, amounting to around $1 billion.

Ledger’s hard lesson: Being right isn't good enough by David Z. Morris, Coindesk

David Morris provides commentary on hardware wallet manufacturer Ledger's recent communications snafu: the company faced backlash and speculation around the integrity of their products after introducing a new social-based seed phrase recovery service, leading to concerns about compromised devices. Ledger's communication mishaps exacerbated the situation, highlighting the importance of clear and careful communication in the crypto industry, particularly as it attracts users with limited technical knowledge.

Emails, chat logs, code and a notebook: The mountain of FTX evidence by David Yaffe-Bellany and Matthew Goldstein, New York Times

This piece for the New York Times walks us through the substantial quantity of evidence against FTX and Sam Bankman-Fried. The evidence includes millions of pages of emails, digital records, encrypted group chats, and personal interviews. This is among the largest corpus of evidence ever collected for a white collar case and showcases the legal challenges faced by SBF and his legal team. A great breakdown of the evidence for those following the FTX saga.

The Bitcoin mining debate is ignoring the people most affected by Cheyenne Ligon, Nikhilesh De, Doreen Wang, Coindesk

Coindesk delivers a substantial addition to the Bitcoin mining debate and the controversy surrounding the Greenidge Generation power plant in Dresden, New York, which mines bitcoin. The plant has faced opposition from environmentalists who argue that it harms aquatic life and contributes to environmental issues such as harmful algal blooms. However, the article highlights that some of the claims made by environmentalists have been disproven by state-collected data and that there is a broader philosophical and value-based debate at the core of the conflict. Incredible investigative journalism — this thorough report should be commended for all of the in-person investigations, interviews, field work and research that went into shedding light on this hotly debated topic.

The dogecoin developer by Brady Dale, Axios

A rare and refreshing look at the good coming out of crypto, Brady shares the story of a resident of Pittsburg, Kansas, who invested his 2020 stimulus check into Dogecoin, multiplied his money, and used the profits to purchase abandoned buildings in downtown Pittsburg. With the help of business partners, he has expanded the project to rehabilitating three empty buildings, coinciding with the upcoming arrival of a major new tenant in the area.

Caroline Ellison: How a young math whiz with an appetite for risk became a major player in Sam Bankman-Fried’s corrupt crypto empire by Courtney Rubin, Fortune

Caroline Ellison, the former co-CEO of cryptocurrency trading firm Alameda Research, has pleaded guilty to charges including wire fraud, commodities fraud, and money laundering. Courtney Rubin does a decent job of showing Caroline’s human side — the article delves into her motivations, upbringing, and struggles with morality, providing insights into the ethical dilemmas faced by individuals in the cryptocurrency world.

5 years after the $500K Ethereum wager between Joe Lubin and Jimmy Song, who won? by Sage D. Young, Elaine Ramirez, Coindesk

Thank you to Sage and Elaine for bringing us back to a simpler time in crypto: Joe Lubin and Jimmy Song’s epic bet. The terms of the bet stated that for Lubin to win, five or more Ethereum DApps needed to maintain 10,000 daily active users and 100,000 monthly active users for at least six months in any 12-month period before May 23, 2023. The authors do a great job of using on-chain data to support Lubin’s claim and also demonstrate why a clear winner isn’t as easy to declare as we might think.

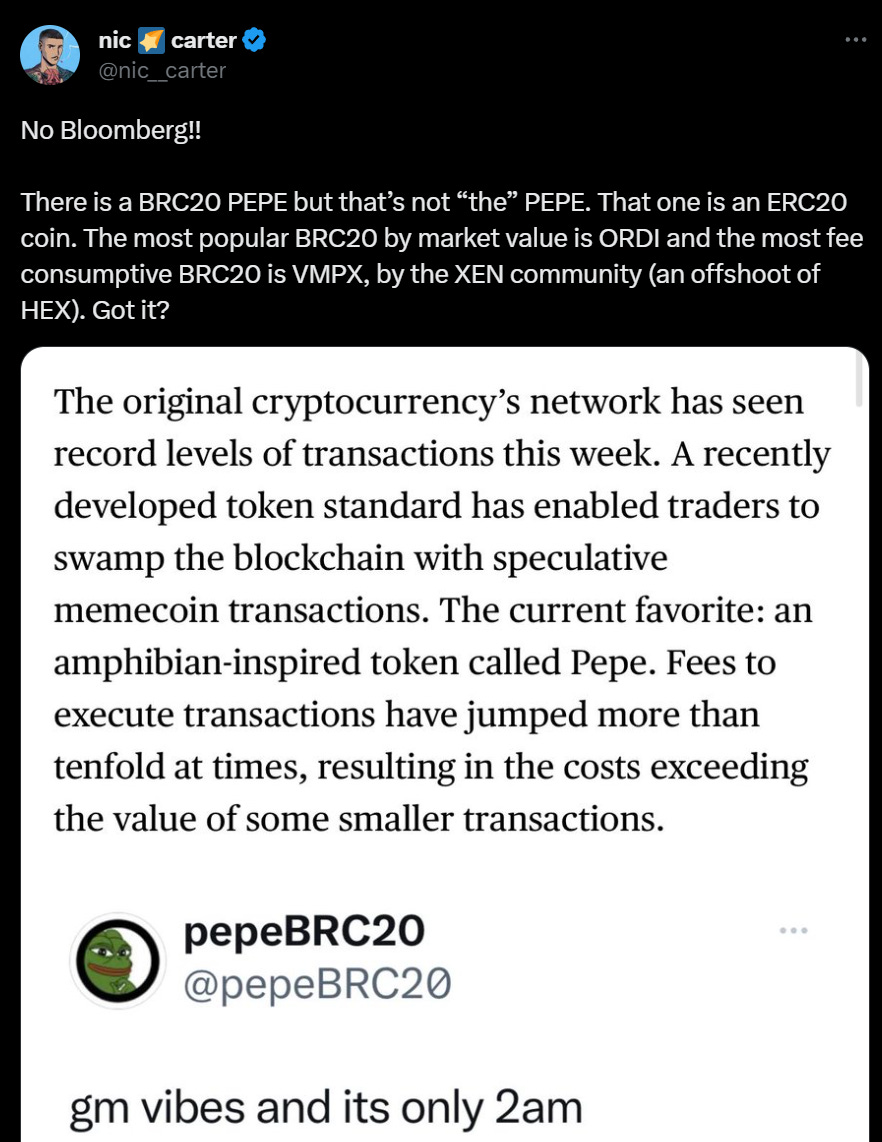

Always do that one extra Google 😢

Especially when dealing with memecoins.

Thanks to Nic for untangling this one for us.

And now — on to some research!

Top crypto research & policy in April & May

BloombergGPT: A large language model for finance by Shijie Wu, Ozan Irsoy, Steven Lu, Vadim Dabravolski, Mark Dredze, Sebastian Gehrmann, Prabhanjan Kambadur, David Rosenberg, Gideon Mann, Bloomberg

The research paper behind Bloomberg’s domain-specific LLM. This paper details the design and training methodology of BloombergGPT. Interesting for those who want to learn more about training their own LLM.

Treasury’s new DeFi risk assessment relies on ill-fitting frameworks and makes potentially unconstitutional recommendations by Peter Van Valkenberg, Coin Center

Head of Research at Coin Center Peter Van Valkenberg walks readers through the US Treasury Department’s new risk assessment report. In Peter’s words, the report “correctly acknowledges the much larger illicit finance threat posed by the traditional banking sector, it—nonetheless—engages at length in an unhelpful centralization-versus-decentralization analysis that is confusing and irrelevant to the actual legal questions at stake.”

2023 State of Crypto Report: Introducing the State of Crypto Index by Daren Matsuoka, Eddy Lazzarin, Robert Hackett, Stephanie Zinn, a16z

The Crypto team at a16z put out this State of Crypto report and accompanying interactive dashboard, the State of Crypto Index. Highlights include: Blockchains have more active users, DeFi and NFT activity appear to be rising again, and the US is losing its lead in Web3.

Assimilating the BORG: A new framework for CryptoLaw entities by Gabriel Shapiro, Delphi Labs

Delphi Labs proposes a new type of legal entity, BORGs, which “augment state-chartered entities (legal persons) with autonomous software such as smart contracts and AI.” This paper aims to outline how legal entities can include technological rules and governance processes into their charters, functioning with benefits of tokenized protocols or DAOs but in an entity that can more readily interact with traditional legal systems.

Q&A: Bitcoin Ordinals, Inscriptions, and aigital artifacts by Chris Kuiper, Fidelity Digital Assets

There’s been a lot of talk about “NFTs on Bitcoin clogging up the chain.” This piece from Fidelity offers a primer on Ordinals, Inscriptions, and how this trend could impact the future of Bitcoin. Everything you want to know about the latest thing people are mad at Eric and Udi about but were afraid to ask, all in one article.

Messari State of the Chain Reports by Messari Team

Messari shared eight ‘State of’ reports on popular blockchains after the close of Q1 2023: Cardano, BNB Chain, Braintrust, Hashflow, Polkadot, 1inch and Ethereum.

Web3 Development Report (Q1 2023) by Alchemy Team

This developer report from Alchemy highlights recent significant milestones in web3 development, including increased adoption of layer 2 rollups and zero knowledge protocols, and developer activity growth. The report is a good example of the resilience of the crypto and web3 industry that developer activity remained strong amid market volatility and showcases the emerging trends and innovations.

Top crypto video in April & May

How did a malicious validator steal $20 million from MEV bots? By EigenPhi

A complex attack made slightly less complex with plenty of charts for you visual learners out there.

Top crypto unhinged tweets in April & May

Important to set the record straight

Nic is a shepherd to the lost.

The Defiant didn’t need to call us out like that.

May you find patience to wait until our newsletter next month. Until then, find us on Telegram and Twitter!

Subscribe now! It’s never too late — in crypto, there’s no such thing.

Join the ACJR

It’s easy to join the ACJR — journalist memberships are only $25 a year. If you want access to our members’ only chat, discounts for conferences and invites to meetups, sign up here.

Reach out to Joyce Pavia Hanson: @JPHanson on Telegram for any more questions.