🌻Your summer crypto beach reads in one massive issue 🍁

The biggest crypto newsletter of the summer, featuring top journalism crypto hits to keep you entertained while the seasons change.

This summer has been hot. So hot that it’s broken multiple records. As everyone knows from statistics class, when it’s hot out: ice cream sales go up and crypto markets explode. The shaky market conditions we saw in June continued spiraling out of control as Terra’s collapse and the fall of Three Arrows Capital blasted a crypto-whale-sized hole through the industry. As the bear market continues and the tide further recedes, we’re seeing that more and more projects were actually swimming naked.

External pressure is mounting, this time in the form of sanctions imposed by the U.S. Treasury Department against the Ethereum-based privacy service Tornado Cash. There’s certainly plenty of drama as we approach the season finale of Crypto Summer ‘22 with the Ethereum Merge estimated to finalize in September.

With all of these newsworthy events going on, we have our top picks in both journalism and research to help you make sense of it all.

Off the Record returns — how to get the scoop

The ACJR’s Off the Record season 5 has returned, with even more sessions that help journalists and researchers understand how to cover often confusing or complex crypto topics.

The next OTR session will take place on September 20 at 2pm EST and features a conversation moderated by Blockworks’ David Canellis with Coindesk’s Danny Nelson on how to get the big scoop in crypto, what tools you can use to investigate stories and how to edit pieces to foster audience engagement.

Danny has been behind reporting on how Solana — the hottest new blockchain of 2021 — was double counting the total value locked on-chain, artificially inflating its ranking amongst other blockchains. As an editor, he’s helped shepherd investigative stories including exposing sexual predators hiding behind anon handles in the DeFi space, looking for Three Arrows’ assets and “quiet” disclosures in Coinbase’s filings.

Got an opinion?

Our newsletter needs you! What is some crypto journalism and research without a saucy opinion piece to complement it all? Reach out to Molly Jane or Anthony on Telegram if you have some ideas for our next op-ed.

₿ 😎 ₿

Top crypto journalism in July and August

The Ballad of Razzlekhan and Dutch, Bitcoin’s Bonnie and Clyde by Nick Bilton, Vanity Fair

Nick Bilton treats us to the most in-depth account of the antics and investigation into Heather “Razzlekhan” Morgan the “rapper,” and her husband Ilya Lichtenstein, the quirky couple who took the crypto world by storm when they were implicated in the 2016 Bitfinex hack. An insightful look into the character of two of crypto’s most bizarre thieves (even though the piece seems slightly behind the times, seven months after their arrest).

Inside Crypto’s Largest Collapse with Terra’s Do Kwon by Zack Guzman and Zack Abrams, Coinage

The collapse of the LUNA ecosystem will be remembered as one of the most drastic events in crypto history; the fallout from Terra’s collapse is still being uncovered. Zack and Zack sat down with Terra founder Do Kwon to get his side of the story in the days leading up to the collapse. A note here that Terraform Labs was an investor in Coinage’s parent company, a fact that Zack Guzman had discussed in a tweet thread.

Master of Anons: How a Crypto Developer Faked a DeFi Ecosystem by Danny Nelson and Tracy Wang, Coindesk

While anonymous founders are becoming par for the course in DeFi, the creator of Solana-based stablecoin exchange Saber went one step further in creating an elaborate web of different protocols, all with the goal of obfuscating how much his platform was being used to artificially inflate the price. With DeFi scams often quickly coming and even more quickly going, this Coindesk exposé was a great way to stop and really think about the potential for fraud bubbling under the surface of DeFi protocols.

Michael Saylor Bet Billions on Bitcoin and Lost by Paul Vigna, The Wall Street Journal

Many of Bitcoin’s loudest advocates collectively poured one out for famously bullish Michael Saylor when MicroStrategy announced that he would be stepping down as CEO. The announcement came after the company reported losses for the seventh straight quarter in a row. Written before the news this week that Saylor (and MicroStrategy) were being sued for tax fraud, character studies like this into Saylor could prove to be important snapshots in the future of one of the biggest Bitcoin bulls at this uncertain point in time.

Meet Crypto Twitter’s Latest Meme: ‘Let’s Form Group!’ by Ben Munster, Decrypt

A new twist on “LFG” emerged on Twitter recently. The popular rallying cry of Crypto Twitter users and nomen inspirationis of Do Kwon’s Luna Foundation Guard, which typically stands for “let’s fucking gooo,” was reported by a Forbes contributor to mean ‘let’s form group.’ Ben gives us some of the best replies and presents valid criticism of the level of quality produced by the Forbes contributor network.

The Crypto Market Crashed. They’re Still Buying Bitcoin. by David Yaffe-Bellany, The New York Times

In this piece, David Yaffe-Bellany introduces readers to the latest main characters in the Bitcoin Maximalist (aka maxi) camp like Cory Klippsten, who recently had a series of prescient tweets about Terra and Celcius, and fan favorite Jimmy Song. The commentary from the maxis included shows how parts of the Bitcoin community are reacting to more global attention from regulators and users alike.

Inside a Web3 Grift Factory by John Biggs

Like Upton Sinclair in The Jungle, John Biggs peels back the cheap veneer making up the lowest quality pump and dump projects and uncovers a group of “influencers” using social media to attempt to manipulate crypto markets. An interesting expose of the dark side of crypto and reminder to perform due diligence when researching any new project.

Ethereum Mining Pools Will Survive The Merge—What About the Miners? by Sander Lutz, Decrypt

Ethereum’s upcoming Merge, the long-awaited transition to proof-of-stake, will force individual miners running hardware to decide what to do with their soon-to-be unused hashing power. While the large companies providing mining pools will see little disruption in their overall business, the individuals who run GPUs to mine Ethereum have few options — and their voices can often be lost in the excitement of update. This piece dives into the issues with the smaller miners that will be left mining a most-likely worthless ETH PoW chain.

Behind Voyager’s Fall: Crypto Broker Acted Like a Bank, Went Bankrupt by Danny Nelson, David Z. Morris, Coindesk

Crypto lender Voyager Digital, which once boasted over 3 million users, is one of the more recent casualties in the wake of the collapse of the Terra ecosystem. After LUNA imploded, the Singapore-based hedge fund Three Arrows Capital seemingly defaulted on all of their outstanding loans — the fund also happened to be one of Voyager’s largest customers. With crypto companies dropping like flies in the bear market, coverage into what exactly went wrong in each case might (only might) help to understand how to prevent future crashes in the future.

How a Fake Job Offer Took Down the World’s Most Popular Crypto Game by Ryan Weeks, The Block

Earlier this summer, “play-to-earn” or “P2E” was one of the hottest trends in crypto — the Web3 gaming revolution had begun! Axie Infinity was a figurehead for the movement with nearly 3 million daily active users and stories about unbanked citizens of Southeast Asia playing the game to earn a living. Ryan Weeks reveals how Axie Infinity and the Ronin bridge were compromised in one of crypto’s largest hacks to date.

And now — on to some research!

₿ 😎 ₿

Top crypto research in July and August

Data Determines Humanity: An Exploration of Decentralized Cloud Storage by Hunter Lampson

Hunter does a thorough deep dive into decentralized cloud storage providers, platforms that he argues are essential to a human-centered digital future. In the article, Hunter considers Storj, Sia, Arweave and Filecoin and compares them to the Big Three centralized providers: Amazon AWS, Google Cloud Storage and Microsoft Azure.

Arbitrum Nitro: a Second Generation Optimistic Rollup by Offchain Labs

Nitro is a second-generation rollup conceived by the development team behind Arbitrum. The Nitro whitepaper explores the key upgrades Nitro boasts over Arbitrum v1: higher throughput, faster finality and more efficient dispute resolution.

Improving Proof of Stake Economic Security via MEV Redistribution by Tarun Chitra, Gauntlet; Kshitij Kulkarni, Berkeley

Miner extractable value, or MEV, is the sometimes controversial “best kept secret” of the crypto world where practitioners are rescuing NFTs or hundreds of ETH in whitehat efforts, or profiting millions of dollars through capturing arbitrage opportunities so miniscule some might question the ethics of the transactions. This paper by Tarun and Kshitij sheds some light on how MEV can be a force for good in a proof of stake environment and models some of the incentive mechanisms behind good behavior.

Automated Market Making and Loss-Versus-Rebalancing by Jason Milionis, Columbia University; Ciamac C. Moallemi, Columbia University; Tim Roughgarden, Columbia University, a16z Crypto; Anthony Lee Zhang, University of Chicago

This paper proposes a metric the authors call loss-versus-rebalancing (LVR), an attempt at a predictable measure of the running cost of providing liquidity to an automated market maker that must be offset in order to generate profit.

Analysis: What is and what is not a sanctionable entity in the Tornado Cash case by Jerry Brito, Peter Van Valkenburgh, Coin Center

Coin Center presents a detailed analysis of the U.S. Treasury Department sanctions against Tornado Cash, citing regulatory and legal precedent to argue that the entities added to the Specially Designated Nationals and Blocked Persons (SDN) list are ineligible and an overreach of the Office of Foreign Assets Control’s power.

₿ 😎 ₿

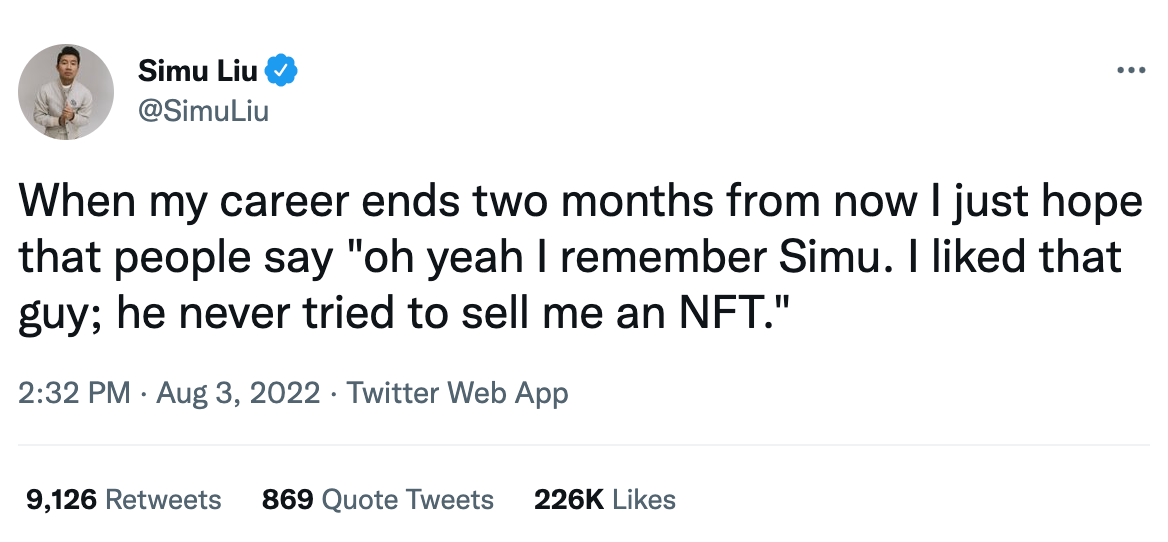

Top crypto unhinged tweet in August

This month’s crypto tweet comes from Simu Liu, the latest Marvel star. We love his foresight.

This massive summer newsletter issue now comes to an end. Get ready for our next newsletter officially of the fall, and until then, find us on Telegram, Twitter and Discord to stay up-to-date on the crypto news.

Subscribe below! It’s never too late — in crypto, you’re always early.